EVA DEADLINE ALERT: Hagens Berman, National Trial Attorneys, Encourages Enviva Inc. (EVA) Investors with Significant Losses to Contact Firm's Attorneys, Securities Fraud Class Action Pending

ACCESS Newswire

16 Nov 2022, 19:43 GMT+10

SAN FRANCISCO, CA / ACCESSWIRE / November 16, 2022 / Hagens Berman urges Enviva Inc. (NYSE:EVA) investors who suffered significant losses to submit your losses now.

Class Period: Feb. 21, 2019 - Oct. 11, 2022

Lead Plaintiff Deadline: Jan. 3, 2023

Visit: www.hbsslaw.com/investor-fraud/EVA

Contact An Attorney Now: [email protected]

844-916-0895

Enviva Inc. (NYSE:EVA) Securities Fraud Class Action:

The litigation challenges Enviva's statements regarding its wood procurement processes and business model.

Specifically, Enviva has attracted ESG investors by claiming that it does not engage in clear-cutting forests to produce its wood pellets - the controversial practice of removing full swaths of forest which is widely condemned by climate change advocates and shunned by the ESG investor community. In addition, Enviva claims that its harvesting forests for wood pellets is sustainable and produces lower greenhouse gas emissions than coal because it is only harvesting waste left by the timber industry, scraps that otherwise would be left to rot on the forest floor.

According to the complaint, these statements were false and misleading in that they failed to disclose that: (1) Enviva was engaging in clear-cutting of forests; and (2) Enviva had overstated the true measure of cash flow generated by its platform.

The truth emerged on Oct. 12, 2022, when activist investment firm Blue Orca released a scathing report accusing the company of 'engaging in textbook greenwashing.' Blue Orca claims that after geolocating Enviva's harvests, satellite imagery reveals hundreds of images of clear-cut forests, suggesting that the practice is widespread and that Enviva is misleading investors.

Blue Orca further contends that contrary to the company's public statements of purchasing on average less than 30% of the wood from each harvest, Enviva's track and trace data and interviews with former employees demonstrate that the company takes upwards of 70% of the volume.

In addition, Blue Orca concludes, Enviva is 'a dangerously levered serial capital raiser whose deteriorating cash conversion and unprofitability will drain it of cash next year' and is 'a product of deranged European climate subsidies which incentivize the destruction of American forests so European power companies can check a bureaucratic box.'

This news sent the price of Enviva shares crashing 13% lower on Oct. 12, 2022, wiping out over $500 million of shareholder value.

'We're focused on investors' losses and proving Enviva has engaged in greenwashing,' said Reed Kathrein, the Hagens Berman partner leading the investigation.

If you invested in Enviva and have significant losses, or have knowledge that may assist the firm's investigation, click here to discuss your legal rights with Hagens Berman.

Whistleblowers: Persons with non-public information regarding Enviva should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email [email protected].

# # #

About Hagens Berman

Hagens Berman is a global plaintiffs' rights complex litigation law firm focusing on corporate accountability through class-action law. The firm is home to a robust securities litigation practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and fraud. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

Contact:

Reed Kathrein, 844-916-0895

SOURCE: Hagens Berman Sobol Shapiro LLP

View source version on accesswire.com:

https://www.accesswire.com/726146/EVA-DEADLINE-ALERT-Hagens-Berman-National-Trial-Attorneys-Encourages-Enviva-Inc-EVA-Investors-with-Significant-Losses-to-Contact-Firms-Attorneys-Securities-Fraud-Class-Action-Pending

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Pittsburgh Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Pittsburgh Star.

More InformationPennsylvania

SectionGeorgia jury hits Bayer with $2.1 billion verdict over roundup claims

NEW YORK CITY, New York: A jury in Georgia has ordered Bayer, the parent company of Monsanto, to pay nearly US$2.1 billion to a man...

Pirates call up RHP Thomas Harrington for MLB debut vs. Rays

(Photo credit: Jonathan Dyer-Imagn Images) The Pittsburgh Pirates called up right-handed prospect Thomas Harrington to make his major...

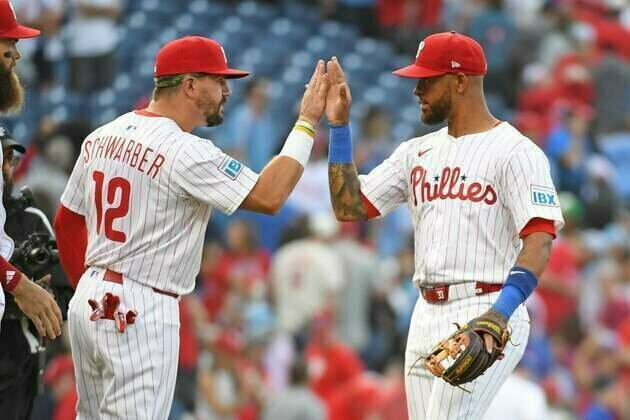

Phillies seek faster start out of blocks in clash vs. Rockies

(Photo credit: Eric Hartline-Imagn Images) Edmundo Sosa and the Philadelphia Phillies have not been fast starters this season. They...

Blue Jays' Jose Berrios bids to execute pitches vs. Nationals

(Photo credit: Nathan Ray Seebeck-Imagn Images) Toronto Blue Jays right-hander Jose Berrios has a chance to make amends for his Opening...

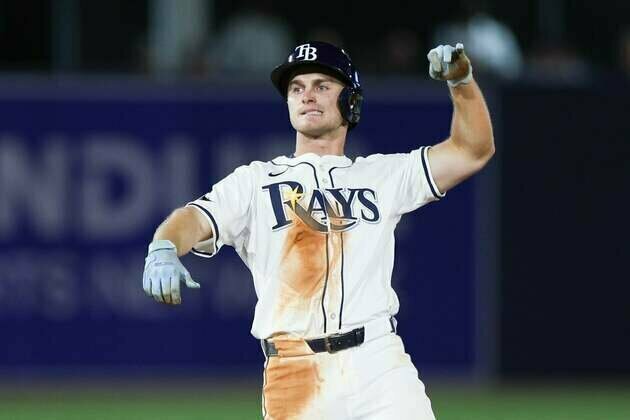

Jake Mangum, Rays hope for repeat performance vs. Pirates

(Photo credit: Nathan Ray Seebeck-Imagn Images) The roots of the legend of Jake Mangum, the Tampa Bay Rays' early-season star, firmly...

Roundup: Nearly 2,000 U.S. scientists sound alarm over Trump's assault on research

Researchers work at the lab of the contract research organization (CRO) Frontage in Chester County in Pennsylvania, the United States,...

International

SectionBoeing to face trial this summer in 737 MAX fraud case

WASHINGTON, D.C.: Boeing is now heading to trial this summer, after a U.S. judge unexpectedly set a date in the criminal fraud case...

Wildfires rage in Carolinas as dry winds, downed trees fuel flames

RALEIGH/COLUMBIA: Dry weather, strong winds, and fallen trees from Hurricane Helene have sparked wildfires in North Carolina and South...

Red Cross outraged after killing of Gazan ambulance crews

GENEVA,.Switzerland - The International Federation of Red Cross and Red Crescent Societies (IFRC) has expressed profound outrage following...

Tesla to launch in Saudi Arabia next month after years of tension

RIYADH, Saudi Arabia: Tesla is finally entering Saudi Arabia, with a launch scheduled for next month—marking a significant shift in...

Apple likely to escape EU fine after browser changes

BRUSSELS, Belgium: Apple appears to have dodged a major regulatory setback in Europe, following recent changes to how users select...

FBI probing increased violence against Tesla

WASHINGTON, D.C: FBI Director Kash Patel said this week the bureau was probing what he called the increase in violent activity toward...