Lemelson Capital Management Reports Preliminary FYE 2021 Results

ACCESS Newswire

14 Jan 2022, 19:49 GMT+10

Short and long positions contribute to FYE 2021 combined[1] net returns of 56 percent. Estimated MTD January 2022 net returns over 30 percent.[2]

SHELBURNE, VT / ACCESSWIRE / January 14, 2022 / Lemelson Capital Management, LLC (LCM), today announced financial results for FYE 2021. The firm posted combined net returns of 56.05 percent for FYE 2021, comparing favorably against the benchmark S&P 500 Total Return Index,[3] which returned 28.72 percent during the same period.

As of January 13, 2022, estimated MTD net returns exceed 30 percent net of all fees and expenses.

'We concluded 2021 with a better than average rate of return and kicked off January 2022 with strong returns,' said Fr. Emmanuel Lemelson, Chief Investment Officer. 'Notably, Generac Holdings, Inc. (NYSE: GNRC), Revolve Group, Inc. (NYSE: RVLV) and Trex Company Inc (NYSE: TREX) contributed to our returns on the short side, while Berkshire Hathaway, Inc. (NYSE BRK.B) First American Financial (NYSE: FAF), and Progressive Insurance (NYSE: PGR) which we are long, performed well,' Lemelson continued. 'However, investors should not expect these sorts of returns in the future,' Lemelson cautioned.

LCM will host an investor conference call on The Fund's FYE 2021 financial results at 10:00 a.m. EST on January 14, 2022. This call will also be available for replay for approximately two weeks after that. Register for the call here.

Contact [email protected] to request a copy of the FYE 2021 investor letter.

LCM periodically provides information for investors on its corporate website, LemelsonCapital.com, and its related site, Amvona.com. This includes press releases and other information about financial performance, reports filed or furnished with the SEC, information on corporate governance, and details related to its annual meeting of shareholders.

-------------------------------------------------------------------------------------------------------------------------------

About Lemelson Capital Management

Lemelson Capital Management, LLC is a private investment management firm focused on deep value and special situation investments.

Follow LCM on Twitter @LemelsonCapital - Follow Fr. Emmanuel Lemelson on Twitter @Lemelson

------------------------------------------------------------------------------------------------------------------------------

Investor Relations contact

Lemelson Capital Management, LLC

Investor and Media Relations

Telephone: 802-332-3833

NOTICE AND DISCLAIMER:

This report shall not constitute an offer of interests in any fund, which may only be made pursuant to the confidential private offering memorandum, related subscription agreement, and applicable laws and regulations.

Any information on specific investments or opportunities is provided merely to illustrate the research process that may be utilized by the Advisor and should not be relied upon in making an investment decision with respect to the investments covered by the report. Investment processes are subject to change without notice.

Any performance data included with respect to any client account of the Advisor represents the net performance (except where gross and net are both presented) of and reflects the deduction of all account or vehicle level expenses, including without limitation brokerage and other transaction costs, as well as legal, audit, administration, and other expenses. Any performance presented would not represent the return of any individual investor. An individual investor's net return in any collective investment vehicle may differ significantly from any net performance as stated herein due to differences in fee arrangements and timing of investment. In fact, any net returns of a vehicle shown herein may be significantly higher than an investor's actual return. Any performance information includes the reinvestment of all dividends, interest, and other income. Past performance is not necessarily indicative of future results. All investments involve risk, including the potential loss of principal.

Any performance results should not be considered a substitute of, or indicative of the past or future performance. 2021 Returns are estimated and unaudited, and actual returns may vary from the performance information presented above. Estimated returns should not be construed as providing any assurance or guarantee as to actual returns. Actual performance figures are only computed and audited yearly. Past performance is not indicative of future results, which may vary. The value of investments and the income derived from investments can go down as well as up. Future returns are not guaranteed, and a loss of principal may occur. An investment in any fund is subject to a variety of risks (which are described in the Fund's Confidential Offering Memorandum), and there can be no assurance that an account's investment objective will be met or that it will not incur losses. This information does not constitute an offer to sell or the solicitation of an offer to purchase any interest in any fund or other investment product. Any such offer or solicitation may only be made by means of delivery of the Fund's offering documents.

Any specific securities identified and described in this material do not represent all of the securities purchased, sold, or recommended for any account. The audience should not assume that investments in these securities identified and discussed have been or will continue to be profitable. Investment examples are included merely to illustrate the investment process and strategies that may be utilized. The Fund currently owns numerous other securities in various other industries and sectors unrelated to these securities. The purchase of these securities only will not create a diversified portfolio. In addition, such securities are subject to losses as an investor may lose money investing in such securities.

Indices included to show the general trend of the securities markets in the periods indicated. No representation is made that the strategies are or will be comparable, either in composition or element of risk involved, to the securities comprising the selected indices. S&P 500® Total Return Index (SPTR): A market value-weighted index of 500 stocks chosen for market size, liquidity, and industry grouping, among other factors. This index is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large-cap universe. This index reflects the effects of dividend reinvestment.

[1] The Spruce Peak Fund, LP launched on March 1, 2021. The results reflect a full year of returns, including those of the predecessor Axia Fund, LP which utilized the same strategy and was discontinued on February 28, 2021.

[2] Based on preliminary unaudited results. The returns are net of all fees and expenses that would be incurred by a hypothetical day-one investor. For a further explanation of how LCM calculates results, please read the disclosure above.

[3] The S&P 500 Total Return Index includes the reinvestment of dividends

SOURCE: Lemelson Capital Managemenet, LLC

View source version on accesswire.com:

https://www.accesswire.com/683424/Lemelson-Capital-Management-Reports-Preliminary-FYE-2021-Results

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Pittsburgh Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Pittsburgh Star.

More InformationPennsylvania

SectionTravelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Reds look to continue making history as they open series vs. Rockies

(Photo credit: Brad Mills-Imagn Images) The Cincinnati Reds need just one win this weekend to continue a unique pursuit of history...

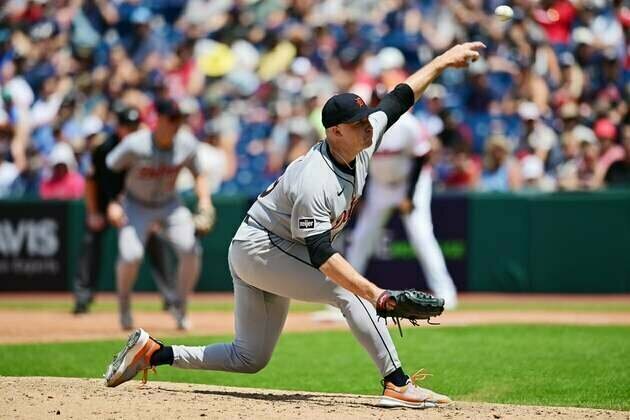

Tigers All-Star Tarik Skubal opens series vs. Mariners

(Photo credit: Ken Blaze-Imagn Images) Tarik Skubal had his final start before the All-Star break moved up. The Seattle Mariners...

Yankees enter series with Cubs on high after comeback win

(Photo credit: Matt Marton-Imagn Images) Pete Crow-Armstrong enters his first trip to Yankee Stadium as a member of the 25-25 club...

CGI New York discusses areas of mutual interest with Chief Academic Officer of Carnegie Mellon University

New York [US], July 11 (ANI): Indian Consulate General in New York, Binaya Pradhan met Provost and Chief Academic Officer of Carnegie...

'The Office' spinoff 'The Paper' release date out

Washington DC [US], July 11 (ANI): Reboot of the popular sitcom 'The Office' titled 'The Paper' has finally got a release date. The...

International

SectionGaza War sucking life out of an Israeli generation

In the past month alone, 23 Israeli soldiers have been killed in Gaza—three more than the number of remaining living hostages held...

Faulty IT system at heart of UK Post Office scandal, says report

LONDON, U.K.: At least 13 people are believed to have taken their own lives as a result of the U.K.'s Post Office scandal, in which...

Travelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Rubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Warsaw responds to migration pressure with new border controls

SLUBICE, Poland: Poland reinstated border controls with Germany and Lithuania on July 7, following Germany's earlier reintroduction...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...