CounterPath Reports Fourth Quarter and Fiscal 2019 Financial Results and Amends Loan Facility

ACCESS Newswire

11 Jul 2019, 17:49 GMT+10

Year-over-Year Recurring Revenue Growth of 26%

VANCOUVER, BC / ACCESSWIRE / July 11, 2019 / CounterPath Corporation (NASDAQ: CPAH) (TSX: PATH) (the "Company" or "CounterPath"), a global provider of award-winning Unified Communications (UC) solutions for enterprises and service providers, today announced the financial and operating results for its fourth quarter and fiscal year ended April 30, 2019.

Fourth Quarter Fiscal 2019 Financial Highlights

- Quarterly revenue of $2.8 million for the fourth quarter of fiscal 2019, compared to revenue of $2.8 million for the fourth quarter of fiscal 2018.

- Subscription, support and maintenance revenue (revenue of a recurring nature) for the fourth quarter of fiscal 2019 was $1.4 million or 50% of total sales, compared to $1.2 million or 43% of total sales for the fourth quarter of fiscal 2018.

- Gross margin of 85% in the fourth quarter of fiscal 2019, compared to gross margin of 82% in the fourth quarter of fiscal 2018.

- Non-GAAP loss from operations of $0.9 million for the fourth quarter of fiscal 2019, compared to non-GAAP loss from operations of $1.7 million for the fourth quarter of fiscal 2018.

- Net loss of $0.9 million, or $0.15 per share for the fourth quarter of fiscal 2019, compared to net loss of $1.4 million, or $0.24 per share, for the fourth quarter of fiscal 2018.

- Non-GAAP net loss of $1.0 million, or $0.16 per share for the fourth quarter of fiscal 2019, compared to non-GAAP loss of $1.7 million, or $0.28 per share, for the fourth quarter of fiscal 2018.

Fiscal 2019 Financial Highlights

- Annual revenue of $10.8 million for fiscal 2019, a decrease of 13% compared to the $12.4 million in revenue for fiscal 2018.

- Subscription, support and maintenance revenue for fiscal 2019 grew by 26% to $5.4 million year-over-year, representing 50% of total sales for fiscal 2019 compared to $4.3 million or 35% of total sales for fiscal 2018.

- Gross margin of 79% in fiscal 2019, compared to gross margin of 87% in fiscal 2018.

- Non-GAAP loss from operations of $4.7 million for fiscal 2019, compared to non-GAAP loss from operations of $2.2 million for fiscal 2018.

- Net loss of $5.0 million, or $0.84 per share for fiscal 2019, compared to $3.2 million, or $0.59 per share, for fiscal 2018.

- Non-GAAP net loss of $4.8 million, or $0.81 per share for fiscal 2019, compared to non-GAAP loss of $2.2 million, or $0.40 per share, for fiscal 2018.

- Cash of $1.9 million as of April 30, 2019 compared to $2.3 million as of April 30, 2018.

Management Commentary

"We are pleased to have finished the fiscal year by growing both revenue and gross margin for two consecutive quarters, while also reducing cash costs for two consecutive quarters," said David Karp, Interim CEO and CFO. "Our recurring revenue grew to its highest level during the fourth quarter as approximately half of our business is now of a recurring revenue nature which will bode well for future revenue growth and stability. While the fiscal year 2019 was challenging in terms of overall revenue achieved, we accomplished several key milestones."

"We completed the development of our collaboration application and operationalized the collaboration service for Bria, which provides HD video and audio conferencing, and screen sharing capabilities for up to 200 participants in a secure virtual meeting room. The development of the collaboration solution was a significant investment made by the Company over the last two years and the completion of this development enabled the reduction of specific headcount in February 2019, thereby lowering ongoing costs. During the third quarter, we sold our first white-labeled collaboration application to a cloud communications service provider with a focus on serving mid-market and enterprise businesses."

"During the fiscal year, we launched Bria Teams; an SMB focused, subscription-based cloud service. The service securely unifies team communications across desktop and mobile devices, enabling organizations to enhance team productivity. We also integrated our collaboration service within our Bria Teams Pro offering. The all-in-one communications application, Bria Teams Pro, reduces the need to have separate apps such as Slack, Zoom or other messaging and video conferencing services. Bria Teams overlays an organization's infrastructure to leverage its existing investments, reducing both costs and complexity. The industry recognized Bria Teams as a leading UCC (Unified Communication and Collaboration) offering. The offering won TMC's 2019 Unified Communications Product of the Year Award and was named as a finalist for 2019 Best of Enterprise Connect Award against some of the biggest unified communications companies in the industry."

"Another important achievement during the fiscal year was the advancement of our Channel Partner Program. Our Channel Partner Program is essential to the ongoing strategy of the Company as it enables the Company to leverage its sales force, particularly in regions outside of North America. The Channel Partner Program is administered through a self-service web portal, similar to our e-store, enabling our partners to order and manage their customers and end users in a secure and scalable fashion. We now have over 50 channel partners selling subscription-based Bria globally, primarily focused on growing our recurring revenue business."

"While transitioning to recurring revenue is challenging, as the Company sacrifices short term revenue for more stable and repeatable revenue in the future, we believe this is the right direction for the Company, and we continue to make good progress with the transition. Our strategy of offering more value-added cloud-based services such as Instant Messaging, Peer-to-Peer Calling, Screen Sharing and Video Collaboration to our traditional applications will benefit our objective of moving in this direction."

"The unified communications market opportunity is significant. According to new research published by Polaris Market Research, the unified communications (UC) market is anticipated to reach over $186 billion by 2026. We are excited to be participating within a large cross-section of this market given that our recently launched Bria Teams communications and collaboration solution addresses the SMB market, while our comparable white-label solutions address the service provider and enterprise market," added Karp.

Amendment to Loan Agreement

CounterPath also announced today that it has entered into an amended loan agreement (the "Amendment Agreement") with Wesley Clover International Corporation and KMB Trac Two Holdings Ltd. (collectively, the "Lenders"), pursuant to which to Lenders have agreed to amend the existing loan agreement (the "Loan Agreement", together with the Amendment Agreement, the "Amended Loan Agreement") to increase the maximum amount of the loan from $3,000,000 to $5,000,000 and to extend the term of the loan such that all outstanding principal and accrued interest is due on April 11, 2021. Wesley Clover International Corporation owns approximately 25.3% of the Company's common shares and is controlled by the Chairman of the Company, Terence Matthews and KMB Trac Two Holdings Ltd. is represented by Steven Bruk, a director of the Company, and Karen Bruk, Mr. Bruk's spouse. KMB Trac Two Holdings Ltd., Steven Bruk and Karen Bruk own approximately 20.5% of the Company's common shares.

Pursuant to the terms of the Amended Loan Agreement, the loan is unsecured and will be made available in multiple advances at the discretion of the Company and will bear interest at a rate of 8% per year, payable monthly. The outstanding principal and any accrued interest may be prepaid without penalty. The loan is intended to be used for general working capital purposes.

The entry into the Amendment Agreement constitutes a related party transaction under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Amendment Agreement is exempt from the formal valuation requirements of MI 61-101 pursuant to Section 5.5(a) of MI 61-101 as the fair market value of the subject matter of the transaction did not exceed 25% of the Company's market capitalization and is exempt from the minority shareholder approval requirements pursuant to Section 5.7(f) of MI 61-101 as the Amendment Agreement is a non-convertible loan on reasonable commercial terms that are not less advantageous to the Company than if the loan were obtained from a person dealing at arm's length with the Company. As the Amendment Agreement is a related party transaction and was announced less than 21 days before its closing, MI 61-101 requires the Company to explain why the shorter period was reasonable or necessary in the circumstances. In the view of the Company it was necessary to immediately enter into the Amendment Agreement in order to have the funds available and therefore, such shorter period was reasonable and necessary in the circumstances.

Fiscal 2019 Financial Overview

(All amounts in U.S. dollars and in accordance with accounting principles generally accepted in the United States ("GAAP") unless otherwise specified).

Revenue was $10.8 million for the year ended April 30, 2019 compared to $12.4 million in the prior fiscal year. For fiscal 2019, software revenue was $4.7 million compared to $6.3 million in the prior year, subscription, support and maintenance revenue was $5.4 million compared to $4.3 million in the prior year, and professional services and other revenue was $0.7 million compared to $1.8 million in the prior year.

Operating expenses for the year ended April 30, 2019 were $15.9 million compared to $15.2 million in the prior year. Operating expenses for the year ended April 30, 2019 included non-cash stock-based compensation expense of $0.5 million (2018 - $0.6 million). Cost of sales was $2.2 million for the year ended April 30, 2019 compared to $1.6 million in the prior year. Sales and marketing expenses were $4.1 million for the year ended April 30, 2019 compared to $4.3 million in the prior year. For the year ended April 30, 2019, research and development expenses were $5.5 million and general and administrative expenses were $4.1 million compared to $5.5 million and $3.8 million, respectively, in the year ended April 30, 2018.

Interest and other income (expense), net for the year ended April 30, 2019 was $0.2 million compared to ($0.4) million for the year ended April 30, 2018. Interest and other income (expense), net for the year included a foreign exchange gain of $0.3 million, offset by interest expense of $0.1 million. The foreign exchange gain (loss) represents the gain (loss) on account of translation of the intercompany accounts of the Company's subsidiary which are maintained in Canadian dollars and transactional gains and losses resulting from transactions denominated in currencies other than U.S. dollars.

Net loss for the year ended April 30, 2019 was $5.0 million, or $0.84 per share, compared to $3.2 million, or $0.59 per share, for last fiscal year. As at April 30, 2019, the Company had $1.9 million in cash, compared to $2.3 million as at April 30, 2018.

Forward-Looking Statements

This news release contains 'forward-looking statements'. Statements in this news release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, outlook, expectations or intentions regarding the future, including the statements that (1) approximately half of the Company's business is now of a recurring revenue nature which will bode well for future revenue growth and stability; (2) Bria Teams, an SMB focused, subscription-based cloud service, securely unifies team communications and collaboration across desktop and mobile devices, enabling organizations to enhance team productivity; (3) the Company believes that transitioning to recurring revenue for more stable and repeatable revenue in the future is the right direction for the Company; (4) the Company's strategy of offering more value added cloud based services like Instant Messaging, Peer-to-Peer Calling, Screen Sharing and Video Collaboration to its traditional applications will benefit its objective of moving to recurring revenue; and (4) the unified communications market will grow to $186 billion by 2026. It is important to note that actual outcomes and the Company's actual results could differ materially from those in such forward-looking statements. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others: (1) the variability in the Company's sales from reporting period to reporting period due to extended sales cycles as a result of selling the Company's products through channel partners or the length of time of deployment of the Company's products by its customers; (2) the Company's ability to manage its operating expenses, which may adversely affect its financial condition and ability to continue to operate as a going concern; (3) the Company's ability to remain competitive as other better financed competitors develop and release competitive products; (4) a decline in the Company's stock price or insufficient investor interest in the Company's securities which may impact the Company's ability to raise additional financing as required or may cause the Company to be delisted from a stock exchange on which its common stock trades; (5) the impact of intellectual property litigation that could materially and adversely affect the Company's business; (6) the success by the Company of the sales of its current and new products; (7) the impact of technology changes on the Company's products and industry; (8) the failure to develop new and innovative products using the Company's technologies including the refresh of our Software-as-a Service (SaaS) solution; and (9) the potential dilution to shareholders or overhang on the Company's share price of its outstanding stock options. Readers should also refer to the risk disclosures outlined in the Company's quarterly reports on Form 10-Q, the Company's annual reports on Form 10-K, and the Company's other disclosure documents filed from time-to-time with the Securities and Exchange Commission at http://www.sec.gov and the Company's interim and annual filings and other disclosure documents filed from time-to-time on SEDAR at www.sedar.com.

About CounterPath

CounterPath Unified Communications solutions are changing the face of telecommunications. An industry and user favorite, Bria softphones for desktop, tablet and mobile devices, together with Stretto Platform™ server solutions, enable service providers, OEMs and enterprises large and small around the globe to offer a seamless and unified communications experience across any network. The Bria and Stretto combination enables an improved user experience as an overlay to the most popular UC and IMS telephony and applications servers on the market today. Standards-based, cost-effective and reliable, CounterPath's award-winning solutions deliver high-quality voice and video calling, messaging, and presence offerings to our customers such as AT&T, Avaya, Bell Canada, BT, Liberty Global, Ribbon Communications, Uber and Vonex. Visit counterpath.com and follow @counterpath.

Contacts:

David Karp

Interim Chief Executive Officer and Chief Financial Officer

[email protected]

COUNTERPATH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Stated in U.S. Dollars)

| April 30, | April 30, | |||||||

| 2019 | 2018 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash | $ | 1,862,458 | $ | 2,348,883 | ||||

Accounts receivable (net of allowance for doubtful accounts of $619,514 (2018 - $322,638)) | 1,876,896 | 3,509,010 | ||||||

Deferred sales commission costs - current | 122,777 | - | ||||||

Derivative assets | 1,178 | - | ||||||

Prepaid expenses and other current assets | 263,078 | 191,245 | ||||||

Total current assets | 4,126,387 | 6,049,138 | ||||||

Deposits | 94,829 | 98,633 | ||||||

Deferred sales commission costs - non-current | 77,571 | - | ||||||

Equipment | 59,914 | 121,819 | ||||||

Goodwill | 6,541,290 | 6,843,575 | ||||||

Intangibles and other assets | 224,795 | 221,062 | ||||||

Total Assets | $ | 11,124,786 | $ | 13,334,227 | ||||

Liabilities and Stockholders' Equity | ||||||||

Current liabilities: | ||||||||

Accounts payable and accrued liabilities | $ | 2,233,875 | $ | 2,437,733 | ||||

Derivative liability | 4,512 | - | ||||||

Unearned revenue | 2,593,726 | 2,565,876 | ||||||

Customer deposits | 947 | 2,200 | ||||||

Accrued warranty | 52,035 | 63,130 | ||||||

Total current liabilities | 4,885,095 | 5,068,939 | ||||||

Deferred lease inducements | 4,031 | 14,339 | ||||||

Loan payable | 3,000,000 | - | ||||||

Unrecognized tax liability | 9,763 | 9,763 | ||||||

Total liabilities | 7,898,889 | 5,093,041 | ||||||

Stockholders' equity: | ||||||||

Preferred stock, $0.001 par value | ||||||||

Authorized: 100,000,000 | ||||||||

Issued and outstanding: April 30, 2019 - nil; April 30, 2018 - nil | - | - | ||||||

Common stock, $0.001 par value | ||||||||

Authorized: 100,000,000 | ||||||||

Issued: | ||||||||

April 30, 2019 - 5,950,246; April 30, 2018 - 5,930,468 | 5,950 | 5,931 | ||||||

Additional paid-in capital | 75,667,533 | 75,170,181 | ||||||

Accumulated deficit | (68,581,091 | ) | (63,701,685 | ) | ||||

Accumulated other comprehensive loss - currency translation adjustment | (3,866,495 | ) | (3,233,241 | ) | ||||

Total stockholders' equity | 3,225,897 | 8,241,186 | ||||||

Liabilities and Stockholders' Equity | $ | 11,124,786 | $ | 13,334,227 | ||||

COUNTERPATH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Stated in U.S. Dollars)

| Three Months Ended | Year Ended | |||||||||||||||

| April 30, | April 30, | |||||||||||||||

| 2019 | 2018 |

Shares

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videosSubscribe and FollowGet a daily dose of Pittsburgh Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well. News RELEASESPublish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Pittsburgh Star. More Information

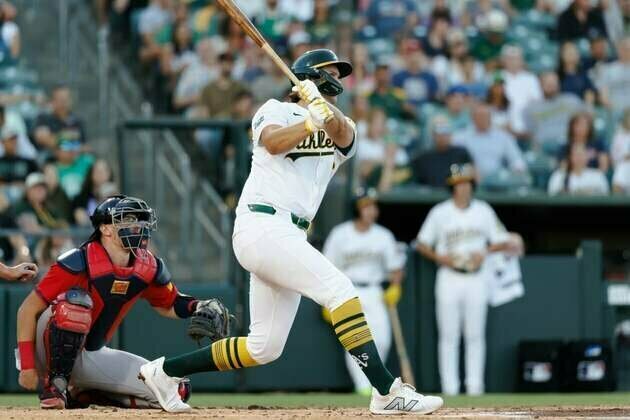

null in null

PennsylvaniaSectionEngine defect prompts Nissan to recall over 443,000 vehiclesFRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential... Cam Schlittler to make MLB debut for Yankees in start vs. Mariners(Photo credit: Steven Bisig-Imagn Images) After a week of angst that saw them fall out of first place in the American League East,... Lawrence Butler homers twice, Nick Kurtz adds slam as A's rout Braves(Photo credit: Sergio Estrada-Imagn Images) Lawrence Butler homered twice and Nick Kurtz belted his first career grand slam to lead... Nick Loftin drives in final three Royals' runs in walk-off of Pirates(Photo credit: Jay Biggerstaff-Imagn Images) After clubbing a go-ahead two-run homer in the seventh inning, Kansas City's Nick Loftin... NBA Summer League sees record prices for admission(Photo credit: Jaime Valdez-Imagn Images) Those looking to watch No. 1 pick Cooper Flagg take on Bronny James in NBA Summer League... Former NFL exec Tim Rooney, nephew of Steelers founder, dies at 84(Photo credit: Jeffrey Becker-Imagn Images) Longtime NFL executive Tim Rooney, the nephew of Pittsburgh Steelers founder Art Rooney... InternationalSectionThousands gather in Himalayas as Dalai Lama celebrates 90th birthdayDHARAMSHALA, India: The Dalai Lama turned 90 on July 6, celebrated by thousands of followers in the Himalayan town of Dharamshala,... Fans perform WWII-era Fascist salute at Marko Perković’s mega concertZAGREB, Croatia: A massive concert by popular Croatian singer Marko Perković, known by his stage name Thompson, has drawn widespread... U.S. Treasury Secretary says Musk should steer clear of politicsWASHINGTON, D.C.: Elon Musk's entry into the political arena is drawing pushback from top U.S. officials and investors, as his decision... TikTok building U.S.-only app amid pressure to finalise saleCULVER CITY, California: TikTok is preparing to roll out a separate version of its app for U.S. users, as efforts to secure a sale... Trump defends use of 'Shylock,' citing ignorance of slurWASHINGTON, D.C.: President Donald Trump claimed he was unaware that the term shylock is regarded as antisemitic when he used it in... Summer travel in chaos as French air traffic controllers walk off jobPARIS, France: A strike by French air traffic controllers demanding improved working conditions caused significant disruptions during... Movie Review | ||||||||||||||